UNDERSTANDING THE LANDSCAPE

Four key elements were established as take-off point for building a robust strategy and roadmap.

PACKAGING MATERIALS CATEGORIES

Different plastic types require different waste processing technologies based on their material properties. The first step to formulating an effective circular economy model is understanding the diverse types of plastics put into the market. This is the basis for determining which type of infrastructure is needed to process them into valuable products in a circular process.

There are two main formats or categories of plastic used for packaging: rigid and flexible. The following section provides a broad categorization of rigid and flexible packaging and their respective diversion and waste processing pathways.

Flexible Plastics

Rigid Plastics

RIGID PLASTICS

Rigid plastic packaging is designed to be much thicker, such as bottles, tubs, and trays.

Polyethylene (PE)

(e.g. HDPE/High-Density Polyethylene or LDPE/Low Density Polyethylene)

Typical Application:

Cosmetic, Soap and Detergent bottles, Caps and Closures for beverage bottles

Diversion Options:

Mechanical Recycling - to Plastic Products

Refill

Polypropylene (PP)

Typical Application:

Ice Cream Tubs, Instant Noodle Cups, Toothbrushes, Microwavable Containers, Non-BPA infant feeding bottles.

Diversion Options:

Mechanical Recycling - to Plastic Products

Refill

Polyethylene Terephthalate (PET)

Typical Application:

Carbonated soft drinks bottles, packaged water bottles, tea drink bottles.

Diversion Options:

Mechanical Recycling - Flakes for Export

Mechanical Recycling - Bottle-to-Bottle

Chemical Recycling

FLEXIBLE PLASTICS

Flexible packaging such as sachets, pouches, and bags are designed to be thin and lightweight for purposes of material and cost efficiency.

Developing circular economy pathways for flexible plastics is challenging. They are often thin and light, structured in multiple layers of different types of plastic, often with metalized or foiled aluminum to achieve the required barrier properties to protect the products. Flexible packaging structures are unique to each product application’s performance, barrier, and shelf life requirements.

The study developed the categories of flexible packaging into six types based on their dominant material composition and their overall material properties that are relevant to recycling and waste processing. The following tables show the 6 different categories of flexible packaging, their typical applications, and diversion options.

Flex#1 PE (above 95%)

Typical Application:

Diaper packaging, laundry products, sanitary protection, bubble wraps, stretch films

Diversion Options:

Mechanical Recycling - Extrusion

Fuel Conversion

Plastic Asphalt Roads

Chemical Recycling

Co-Processing

Flex#2 PE (above 95%)

Typical Application:

Instant noodles, biscuits, chocolates, soft/hard candies

Diversion Options:

Mechanical Recycling - Extrusion

Fuel Conversion

Plastic Asphalt Roads

Chemical Recycling

Co-Processing

Flex#3a PP and/or PE

(above 95%)

Typical Application:

Snack foods, biscuits

Subtypes:

• No aluminum

• With metalized aluminum

Diversion Options:

Mechanical Recycling - Extrusion

Fuel Conversion

Plastic Asphalt Roads

Chemical Recycling

Co-Processing

Flex#3b PP and/or PE

(85%-95%)

Typical Application:

Snack foods, biscuits

Subtypes:

• w/aluminum foil layer

Diversion Options:

Co-Processing

Flex#4

PET, EVOH, PA, etc. above 15%

Typical Application:

Instant noodles, biscuits, chocolates, soft/hard candies

Subtypes:

• No aluminum

• w/metalized aluminum

• w/aluminum foil later

Diversion Options:

Co-Processing

Flex#5 Used Beverage Carton

Typical Application:

Ready-to-drink milk, all-purpose cream

Subtypes:

• No aluminum

• With metalized aluminum

Diversion Options:

Co-Processing

Flex#6 Plastic-Coated Paper

Typical Application:

Labels

Diversion Options:

Co-Processing

WASTE GENERATION QUANTITIES

A key step after defining plastic categories is to determine generation volumes per category. The generation quantity is critical in determining the needed capacity of recycling and waste processing infrastructure to absorb these wastes in various regions of the country going into the future.

It is also important to note the rate of waste generated increases each year as demand for products grows. The infrastructure capacity must take into account the additional generation year-on-year.

Baseline data were provided by the PARMS-FMCG members on 47 product categories that they carry. Each member provided their generation quantity per packaging type by product category.

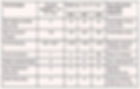

These datasets were overlaid with NielsenIQ’s sector-wide sales data to estimate the total mass of plastic packaging put out in the market by the entire Philippine FMCG industry in 2019. This is presented in the table below.

Mass of Post-Consumer Packaging Waste - All Plastics

CURRENT & PROJECTED INFRASTRUCTURE CAPACITY

An important part of this study was to determine the current and projected capacity of recycling and waste processing infrastructure for both rigids and flexibles. These were determined through key informant interviews and desk research (. Given the close to 100% recycling rate of PP & PE (World Bank Group. 2021), it is assumed that recycling infrastructure is able to take in 100% of the waste generated. Hence, they were no longer included in Table 4, and priority is given to materials that have much lower diversion rates.

As seen in Table below, PET is currently shredded into flakes and exported. Data shows about 104,000 MT of PET is exported as flakes. This can grow up to 409,000 MT by 2030, depending on the progress of PET bottle-to-bottle recycling. Coca-Cola Beverages Philippines, Inc. and Indorama Ventures signed a joint venture agreement for the construction of the country’s largest food-grade, bottle-to-bottle recycling facility, PETValue Philippines. PETValue is a multi-phased P2.28-billion PET-recycling facility that will have an output of 16,000MT per year of recycled PET resin for its first phase of operations. They are projecting an expansion to materialize in its third year, to an output of 32,000 MT of rPET resin. The facility is scheduled to operate in 2022.

The rest of the technologies in Table 4 are options intended for flexibles. Co-processing has a total current capacity of 1.2-1.6 million MT. However, operators have set a limit of 50-km to up to 100-km radius from their facilities from which they can viably collect the flexibles that conform to their acceptance criteria. This means only 63% of the flexible packaging waste generated around the country can be taken-in by co-processing. With a 2021-2030 generation quantity scenario, the realizable capacity of co-processing of about 700,000-1,000,000 MT per year is still well above the generation volumes for flexibles in 2019 through 2030.

Table: Current and Projected Infrastructure Capacity for Rigid PET and Flexibles

BASELINE DIVERSION RATES

The available infrastructure to absorb both rigids and flexibles remain untapped, given the low recycling rates today.

The World Bank estimates that 40-55% of rigid PET packaging is recycled and up to 100% of rigid PE and PP packaging is already recycled (see Annex C for this calculation). Rigid PE and PP command a high price in junk shops (e.g. P10-14/kg in Cavite) as the demand for these materials from local recyclers is quite high. Conversely, The World Bank estimates that 91-96% of flexibles are landfilled and possibly leaked. This means that despite the current co-processing capacity available, recovery and use of these materials remain low at 4-9%.

Flexible packaging costs more to recover from the waste stream. Recyclers are not interested in them because of their low weight and complex multilayer structures. When they are contaminated with other waste, their value steeply declines since washing them increases expenses per ton of recyclable yield.

The system change strategies developed in this study seek to address these recovery challenges through a multi-pronged approach. This approach is geared towards gradually increasing the current diversion rates to 100% from 2021 to 2030, with particular focus on flexibles owing to their extremely low diversion rates as of 2019.

Baseline (2019) Diversion Rates per Plastic Category

Plastic Types Baseline Diversion Rate

Rigid PE Up to 100%

Rigid PP Up to 100%

Rigid PET 40-55%

Flexibles 4-9%